Microsoft Leans on OpenAI’s Chip Designs to Solve Its Hardware Headache

Microsoft Leans on OpenAI’s Chip Designs to Solve Its Hardware Headache

Microsoft is doubling down on a new strategy to overcome its long‑standing difficulties building competitive AI chips — by relying on its partner OpenAI (and its custom‑chip development) to do much of the heavy lifting. Rather than pushing forward full‑steam alone, Microsoft is banking on a revised alliance: use OpenAI’s designs, then adapt and scale them for its own cloud and enterprise needs. :contentReference[oaicite:2]{index=2}

🔧 The Chip Problem — And Why Microsoft Needed a New Plan

- Historically, Microsoft’s efforts to build in‑house AI semiconductors have lagged behind rivals such as Google or Amazon. :contentReference[oaicite:5]{index=5}

- Building cutting‑edge AI chips is extremely costly and technically challenging — requiring massive R&D, hardware design, and long cycles. :contentReference[oaicite:6]{index=6}

- Given those hurdles, Microsoft’s CEO Satya Nadella recently acknowledged that reinventing the wheel may not make sense — instead, they opted to “instatiate what OpenAI builds, then extend it.” :contentReference[oaicite:8]{index=8}

🤝 What the New Partnership Entails

Under the updated agreement between Microsoft and OpenAI:

- OpenAI — in collaboration with chipmaker Broadcom — is developing custom AI chips and system‑level hardware optimized for large models. Microsoft gains full access to these designs. :contentReference[oaicite:10]{index=10}

- Microsoft secures intellectual‑property (IP) rights to adopt and further develop these chip designs for its own infrastructure. :contentReference[oaicite:11]{index=11}

- The only exception: OpenAI’s consumer‑hardware ambitions remain outside the shared IP scope. That means Microsoft benefits from server‑/data‑center‑grade chips, while OpenAI retains autonomy over end‑user devices. :contentReference[oaicite:12]{index=12}

This arrangement helps Microsoft sidestep the time, cost, and risk of designing chips from scratch — while still giving it a path to compete with other AI‑infrastructure players. :contentReference[oaicite:13]{index=13}

🚀 What’s in It for Microsoft (and Why It Makes Sense Now)

- Speed : By building on OpenAI’s existing chip architecture, Microsoft can deploy optimized hardware for AI workloads faster than if it started from zero.

- Reduced risk : Outsourcing the hardest part (chip design) mitigates the risk of failure, resource waste, or delay in a field where small mistakes can be costly.

- Scale‑ready infrastructure : As Microsoft continues to invest in AI services on its cloud platforms (e.g. Azure), having access to proven, high‑performance chips means better margins and competitive positioning — especially vs. rivals heavily reliant on third‑party GPUs.

- Flexibility for innovation : With full IP rights (on non‑consumer hardware), Microsoft can customize, optimize or evolve chip/system designs tailored to its enterprise/cloud needs, without being locked to generic off‑the‑shelf solutions.

⚠️ What This Strategy Doesn’t Solve (or Might Complicate)

- Microsoft still needs to build out the supporting infrastructure: electric‑power supply, data centers, cooling, logistics — hardware is only one piece of the AI‑stack puzzle. Some of these constraints (like energy availability) have already been flagged as bottlenecks even at major firms. :contentReference[oaicite:14]{index=14}

- Relying on a partner for core hardware design may limit Microsoft’s independence: if OpenAI’s roadmap shifts, or its designs don’t scale as expected, Microsoft could be exposed.

- Possibility of internal misalignment: blending OpenAI’s designs with Microsoft’s own needs may require substantial adaptation — and it’s unclear how smooth or efficient that process will be.

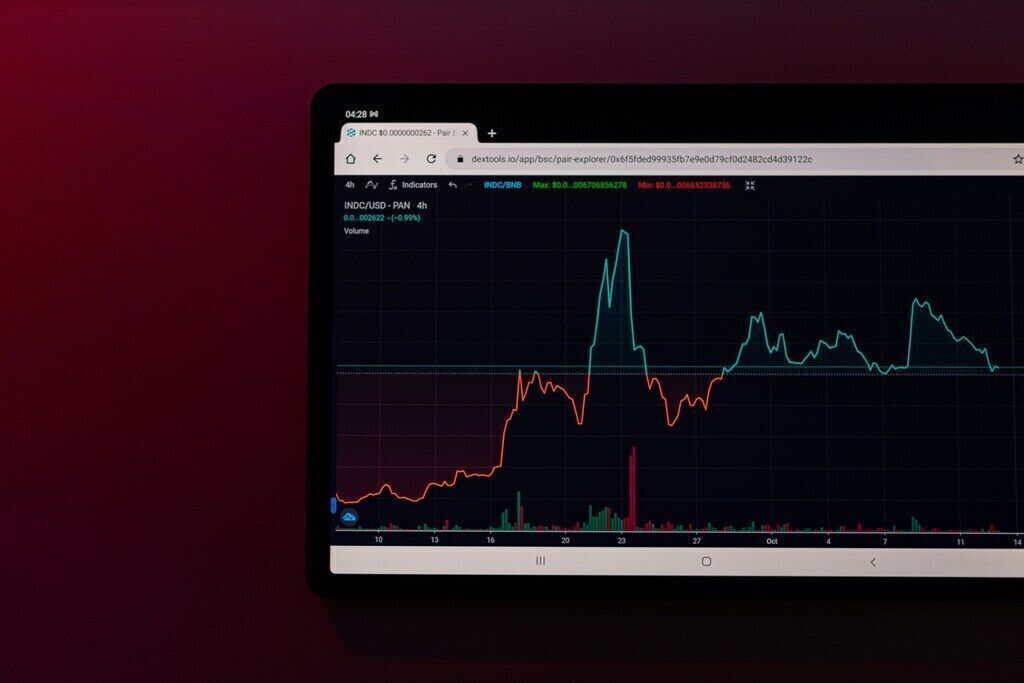

💡 What This Means for the Broader AI Infrastructure Race

- The move highlights a trend: as AI hardware becomes more specialized and expensive, even industry giants may find collaborative hardware development more viable than going solo.

- It suggests shifting definitions of “in‑house chip development”: not every big tech firm needs to build from scratch — strategic partnerships + licensing can accelerate adoption while managing risk.

- For competitors (cloud providers, AI startups, hardware vendors), this may raise the bar: optimized chips + vertical integration could become minimum requirements for high‑performance AI services.