Thanksgiving’s Hidden Showdown: Michael Burry vs Nvidia

Thanksgiving’s Hidden Showdown: Michael Burry vs Nvidia

While many are preoccupied with turkey and holiday plans, a far less festive — but much more consequential — drama is playing out: a high-stakes confrontation between Michael Burry and Nvidia. What makes this showdown so gripping isn’t just the clash of reputations, but the question it raises: is the AI boom real — or built on shaky accounting and hype? :contentReference[oaicite:2]{index=2}

Burry’s Bold Bet Against the AI Hype

Burry, the famed investor made legendary by his prescient shorting of the 2008 housing bubble, has emerged again — this time targeting the heart of the AI wave. Through his fund, Scion Asset Management, he has placed large put-option bets against Nvidia (and also Palantir), signaling he expects their stock prices to fall sharply. :contentReference[oaicite:5]{index=5}

Burry’s critique centers on what he sees as financial obfuscation by AI-software and hardware companies. In his view:

- Many AI customers aren’t real end-users but entities funded via circular deals — inflating “demand” without sustainable revenue. :contentReference[oaicite:6]{index=6}

- Companies like Nvidia may be overstating profits by stretching depreciation timelines for expensive hardware (GPUs), masking the real cost and risk of obsolescence. :contentReference[oaicite:7]{index=7}

- Aggressive stock-based compensation (SBC) has diluted shareholder value: he argues that Nvidia has spent up to US$112.5 billion on buybacks — yet the net effect may have been minimal because of concurrent dilution. :contentReference[oaicite:8]{index=8}

In short: Burry isn’t merely skeptical — he’s betting that the AI boom is a bubble waiting to burst.

Nvidia’s Pushback: “That Math’s Off”

Nvidia didn’t take Burry’s warnings lightly. The company’s investor-relations team recently sent a detailed seven-page memo to Wall Street analysts defending its accounting and corporate strategy. Among the key rebuttals:

- The figure Burry used to claim massive buybacks is allegedly inflated. According to Nvidia, once correct adjustments are made (e.g., for RSU taxes), the real number sits nearer US$91 billion — not US$112.5 billion. :contentReference[oaicite:9]{index=9}

- Its employee compensation levels, including stock-based compensation, are said to be “broadly in line with peers.” :contentReference[oaicite:10]{index=10}

- Nvidia flatly rejected any suggestion that it is comparable to past fraud-tainted companies — calling comparisons to companies like Enron inaccurate and misleading. :contentReference[oaicite:12]{index=12}

In its public defense, Nvidia reasserted confidence in its financial practices, its leading role in AI infrastructure, and the long-term legitimacy of its growth.

The Stakes: Why This Conflict Matters

What’s at risk here is not just the reputation of two powerful entities — but the entire narrative around AI hype, infrastructure investment, and future growth. On one side:

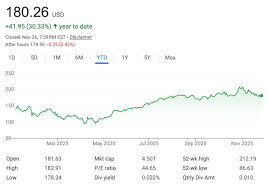

- Nvidia holds a gargantuan market cap, has become one of the most valuable companies in the world, and is widely viewed as a pillar of the AI economy. :contentReference[oaicite:13]{index=13}

- The demand for AI chips seems to be accelerating — but if Burry is right, much of that demand could be cyclical, inflated, or unsustainable. :contentReference[oaicite:14]{index=14}

For Burry — and anyone aligned with his thesis — this isn’t a matter of nitpicking numbers. If he’s persuasive enough to shift investor sentiment, the result could trigger a cascade of sell-offs, valuations collapsing, and a broader reckoning about how we value “AI potential.” As some onlookers note: a powerful critic with a platform might not need to be perfectly right — just influential enough to shake confidence. :contentReference[oaicite:15]{index=15}

So, Is This a Bubble — Or a False Alarm?

It’s too early to say with certainty. History offers both cautionary tales and counterexamples:

- In previous episodes (like with Enron or the dot-com bubble), skepticism from credible voices accelerated downfalls. :contentReference[oaicite:16]{index=16}

- But the AI ecosystem today is arguably more complex and more deeply embedded in many industries than earlier tech bubbles ever were. And long-term contracts, software ecosystems, and diversified customers might shield big firms from a full crash. :contentReference[oaicite:17]{index=17}

For now, we’re watching a battle between conviction and consensus — with enormous implications for the future of technology investing, AI infrastructure, and how markets price innovation.

Whether Burry ends up validated — or mistaken — this standoff highlights a key truth: in markets, perception often matters as much as fundamentals.